Do you expect your Company’s HR and Payroll Teams to save you tax?

We do too.

However, HR teams can only do what can be applied to most employees. Beyond that, we are individually responsible for our tax savings. This is difficult because we don’t know better. We may only complete the basic tax declarations at the end of the year to get some benefits.(E.g. PPF, Mediclaim etc)

This is the biggest mistake we, as an employed workforce, make!

If we took the time to understand how to manage our taxes – we could have between 10-20% more income – – and not just salary in-hand!

This works because when we get more money in-hand; that is, when our salary is less heavily-taxed, we have more in hand to invest. And when we invest, our money can grow and compound more!

Each person qualifies differently for tax-related savings.

Today, we will give you some easy-to-use tools on how to manage your tax so you can increase your in-hand income.

If you need more help – you can reach out to your Jify helpdesk on +91 9820079068. We will direct you to our tax consultants for both filing & advisory.

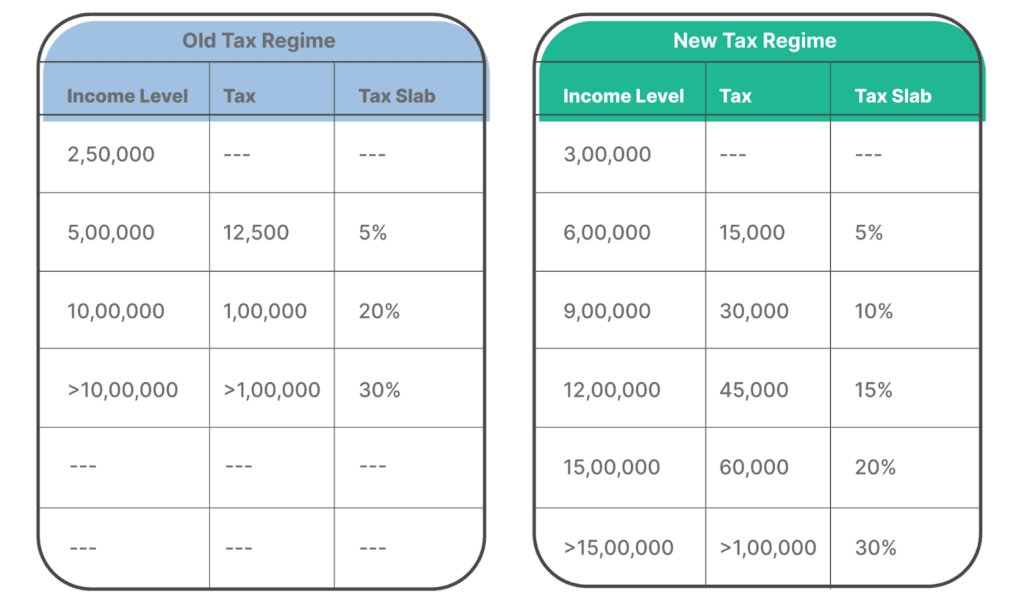

Step 0: Know Your Income Tax Slabs

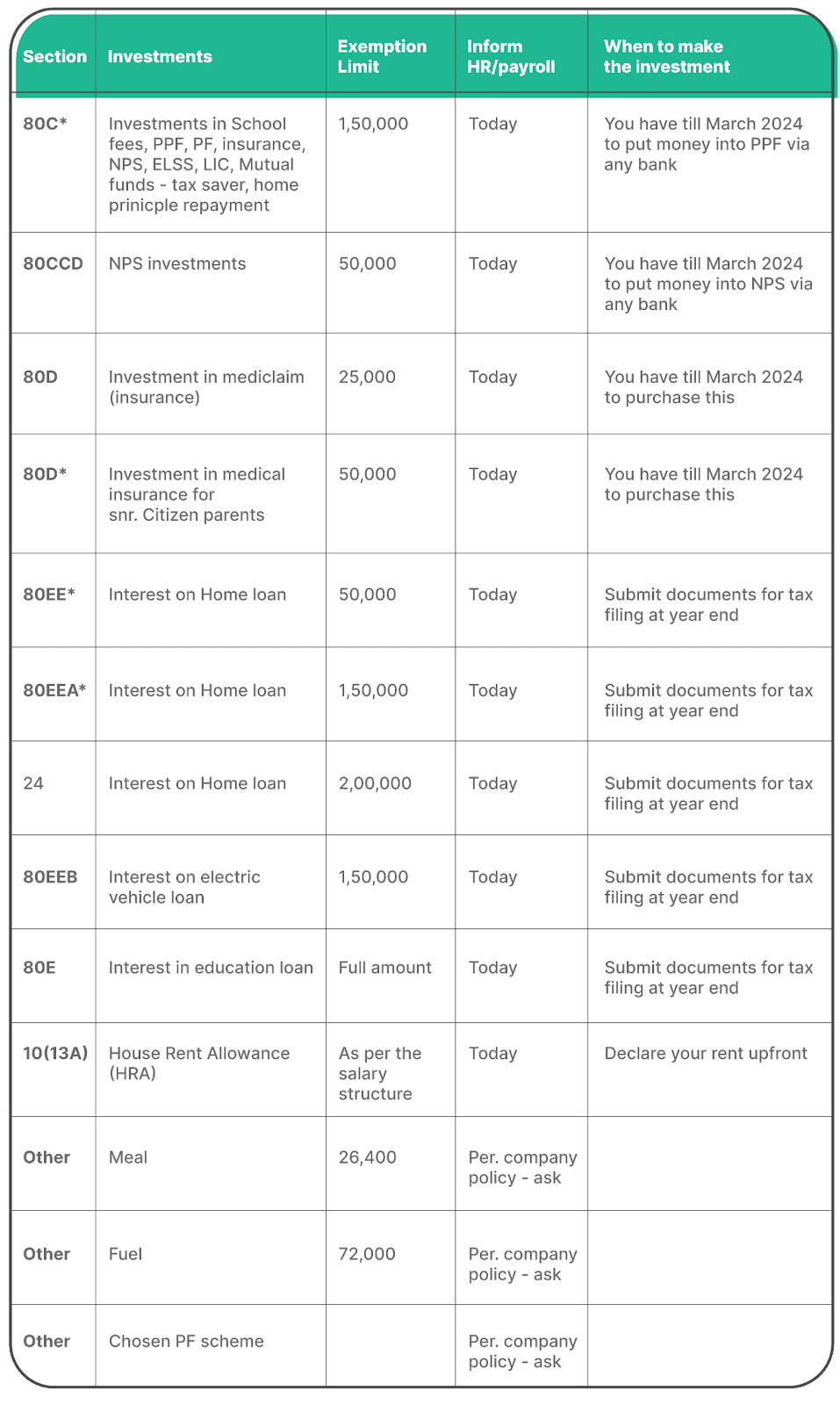

Step 1: Listed below are the tax saving options [Table #1]

Notes

1. 80C*: Mediclaim is 25k for self + 25k for parents if they are not senior citizens, so a total of 50k

If Parents are Sr. citizens it is 25k for self and 50k for parents, so a total of 75k

If self is Sr.Citizen and parents are of course Sr. citizens – 50K + 50K i.e. Total 1Lac

2. Section 24: This is a general home loan section and does not apply to low-cost housing or a particular period etc.E.g. If your interest is 2.5 Lacs, can claim 2 lacs under Section 24 and 50k under 80EEA (if it meets the period + cost criteria); You need to avail of Section 24 first and only then apply against the other sections.

3. 80EE – loan must be sanctioned between 01.04.2016 to 31.03.2017; 80EE and 80EEA cannot be taken together since it is for first-time home buyers only.

4. 80EEA – applicable for Loan taken 2019-2023, with value of home at Rs. 40L and loan value of >Rs.25L;80EE and 80EEA – cannot be taken together since it is for first-time home buyers only.

5. 80C – Can claim housing loan principal portion for home owners who 1) bought a home between 2019-23, with home value of Rs. 40L and loan >Rs. 25L

Step 2: Enter your income in the attached template format to understand how much you can save based on your income

Click the following excel:

Step3: Follow instructions provided against each benefit in Table #1

Summary

Identify the tax deductions & exemptions you qualify for today – and Inform your HR. You can work with our tax experts listed here to INCREASE your take home. We can also guide you on how to save and invest it

If your income >10L per annum, and you are able to maximize the deductions & exemptions, you will save more tax in the old regime [see step 0]

*Disclaimer:

The information contained herein is not intended to be a source of advice concerning the material presented, and the information contained in this article does not constitute investment advice. The ideas presented in the article should not be used without first assessing your financial situation or without consulting a financial professional.